2024 Seattle & Eastside Farmers Markets: Locations, Times & More

Summer is just around the corner, and so are these farmers markets! Spend an evening or weekend finding your new favorites among the tents. Think it’s all about kale? Think again. Most offer live entertainment along with a mouth-watering variety of local brews, cheese, bread, meat/seafood, honey, hand roasted coffee, and other hidden gems (in addition to the freshly picked fruits & veggies).

Seattle Metro

- Ballard

- Capitol Hill (Broadway)

- Columbia City

- Lake City

- Lake Forest Park

- Madrona

- Magnolia

- Phinney

- Pike Place

- Queen Anne

- Shoreline

- U-District

- Wallingford

- West Seattle

Greater Eastside

- Bellevue – Crossroads

- Bellevue – Downtown

- Carnation

- Duvall

- Issaquah

- Kirkland – Downtown

- Kirkland – Juanita

- Mercer Island

- North Bend

- Redmond

- Renton

- Sammamish

- Woodinville

Seattle Metro

Ballard

Seattle’s first year-round Farmers Market, selling produce exclusively from Washington state farmers along the historic cobblestone stretch of Ballard Ave.

Sundays, 9am – 2pm | Year-Round

5345 Ballard Ave NW | Seattle

sfmamarkets.com/visit-ballard-farmers-market/

Capitol Hill (Broadway)

Come for Sunday brunch from food vendors who source ingredients from local, WA state farms (many of whom you’ll also meet selling their wares at the market). Live music and street performers often make an appearance, too.

Sundays, 11am – 3pm | Year-Round

Tuesdays, 3pm – 7pm (June 4 – September 24, 2024)

E Barbara Bailey Way | Seattle

seattlefarmersmarkets.org/chfm

Columbia City

With everything from freshly harvested Asian greens to Ethiopian eats, come check out the immense variety King County’s most diverse zip code has to offer. Bring your bounty to adjacent Columbia Park for a picnic.

Wednesdays, 3pm – 7pm | May 1 – Oct 9, 2024

Special Market Days on Saturday, 11/9/24 & 12/14/24, 10am-2pm

37th Ave S & S Edmunds St | Seattle

seattlefarmersmarkets.org/ccfm

Lake City

This celebrated North End seasonal market offers unique finds grown and prepared by local farms and food artisans. Enjoy kids’ activities, too!

Thursdays, 3pm – 7pm | June 13 – Oct 3, 2024

NE 125th St & 28th Ave NE | Seattle

seattlefarmersmarkets.org/lcfm

Lake Forest Park

With an emphasis on fresh, locally grown food, this market is an epicurean’s delight. Browse hard cider, baked goods, preserves, meat, pasta, sauces, and prepared foods along with the locally harvested fruits and veggies. There is also one “Crafts Market” each summer featuring local artisans.

Sundays, 10am – 2pm | May 12 – Oct 20, 2024

17171 Bothell Way NE | Lake Forest Park

www.thirdplacecommons.org/farmers-market

Madrona

Located in one of Seattle’s most diverse neighborhoods, you’ll find artisan foods as well as seasonal produce from Washington state farmers, fishers, and ranchers.

Fridays, 3pm – 7pm | May 17 – Oct 25, 2024

MLK Way & E Union St | Seattle

sfmamarkets.com/madrona-farmers-market

Magnolia

This popular Saturday market is nestled in the tree-lined Magnolia Village. In addition to seasonal fruits and veggies, you’ll find sweet & savory pies, fresh bread, flowers, and more!

Saturdays, 10am – 2pm | June 1 – Oct 12, 2024

W McGraw St & 33rd Ave W | Seattle

seattlefarmersmarkets.org/mfm

Phinney

A popular gathering spot for both the Phinney Ridge and Greenwood communities, this market is right next door to a playground and offers live music in addition to the great mix of fresh produce and prepared food.

Fridays, 3pm – 7pm | June 7 – Sept 27, 2024

6532 Phinney Ave N | Seattle

seattlefarmersmarkets.org/pfm

Pike Place

No introduction needed…make it a day with great restaurants, eateries and retail shops, too.

Daily, 9am – 6pm (farm tables close at 4pm) | Year-Round (Closed Thanksgiving & Christmas)

Pike Place between Pine & Virginia St | Seattle

(206) 682-7453

pikeplacemarket.org

Queen Anne

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Thursdays, 3pm – 7:30pm | May 30 – Oct 10, 2024

Spring Preview Market on May 11, 2024, 10am-3pm

Harvest Markets on Oct. 26, Nov. 23 & Dec. 14, 2024, 10am-3pm

Queen Anne Ave N & W Crockett St | Seattle

qafm.org

Shoreline

Now located at the BikeLink Park & Ride (corner of 192nd & Aurora, across from Sky Nursery), this market offers kids’ programs and live music in addition to its fresh Washington produce, organic meats, bread, honey, and prepared foods.

Saturdays, 10am – 2pm | June 1 – Oct 5, 2024 + Harvest Markets on Oct. 26 & Dec. 14

18821 Aurora Ave N | Shoreline

shorelinefarmersmarket.org

University District

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Saturdays, 9am – 2pm | Year-Round

University Way NE (the “Ave”) between 50th & 52nd | Seattle

seattlefarmersmarkets.org/udfm

Wallingford

Located in Meridian Park, you can shop with the whole fam and then enjoy a picnic or playtime at the award-winning playground.

Wednesdays, 3pm – 7pm | May 29 – Sept 25, 2024

4800 Meridian Ave N | Seattle

sfmamarkets.com/visit-wallingford-farmers-market/

West Seattle

A South Seattle weekend destination, this market is set in the vibrant West Seattle Junction and features up to 70 vendors during the summertime peak. Great community atmosphere celebrating Washington grown food and ingredients.

Sundays, 10am – 2pm | Year-Round

California Ave SW & SW Alaska | Seattle

seattlefarmersmarkets.org/wsfm

Greater Eastside

Bellevue – Crossroads

East Bellevue’s market features fruits, veggies & dairy products from Washington state farms along with handmade soaps, candles, dog treats, herbal wellness products, and more. Don’t miss the Salvadorean pupusas, Russian-style crepes, and handmade ice cream sandwiches, too!

Tuesdays, 12pm – 6pm | June 4 – Sept 24, 2024

15600 NE 8th St | Bellevue

https://crossroadsbellevue.com/music-events/crossroads-farmers-market/

Bellevue – Downtown

Set in the heart of Downtown Bellevue, this market offers goods exclusively produced within Washington state—from seasonal fruits & veggies to flowers, fresh meats, artisan goods, and prepared cuisine. The Power of Produce (POP) club empowers kids to know where their food comes from and make healthy eating choices.

May 23 – Sept 26, 2024: Thursdays, 3pm – 7pm

Oct 3-24: Thursdays, 3pm-6pm

1717 Bellevue Way NE | Bellevue

bellevuefarmersmarket.org

Carnation

Set in the heart of the Sno-Valley farming district, you’ll find plenty of freshly picked produce along with live music and educational activities for the kids.

Tuesdays, 3pm – 7pm | June, July & August 2024

Tolt-MacDonald Park, 31020 NE 40th St | Carnation

carnationfarmersmarket.org

Duvall

Nestled alongside the scenic Snoqualmie River, this friendly market features local eggs, jams, fresh roasted coffee, arts, crafts, and baked goods in addition to the seasonal veggies, fruits, and plant starts. Live music, picnic shelters and a playground make this a fun family destination.

Thursdays, 3pm – 7pm | May 2 – October 10, 2024

Taylor Landing at 16201 Main St NE | Duvall

Parking Map

duvallfarmersmarket.org

Issaquah

Located at the historic Pickering Barn, this picturesque venue offers a variety of fresh farm and food-based products, concessions, and local artisans.

Saturdays, 9am – 2pm | May 4 – Sept 28, 2024

Holiday Markets on Oct 26, Nov 23, & Dec 14, 2024

Pickering Barn, 1730 10th Ave NW | Issaquah

Market Map

www.issaquahwa.gov/778/Farmers-Market

Kirkland – Downtown

This stunning setting on the Lake Washington shoreline turns shopping into a day at the beach. Peruse local produce and goods, then go for a swim or stroll along Moss Bay. Perfect for a picnic, too!

Wednesdays, 3pm – 7pm | June 5 – September 25, 2024

Marina Park, 25 Lakeshore Plaza | Kirkland

kirklandmarket.org

Kirkland – Juanita

Set in beautiful Juanita Beach Park on Lake Washington, you’ll find as many as 30 vendors offering farm fresh local produce, herbs, honey, nuts, flowers, plants, baked good, handcrafted items, and prepared cuisine. Make it a date with live music and a picnic at the beach. There’s a great playground for the kids, too.

Fridays, 3pm – 7pm | June 7 – Sept 27, 2024

Juanita Beach Park, 9703 NE Juanita Dr | Kirkland

www.kirklandwa.gov

Mercer Island

Come on down for quality local Washington state produce, cheese, fish, meat, bread, and more. Check out the live music schedule, too!

Sundays, 10am – 2pm | June 2 – Sept 29, 2024

Harvest Market on Nov 24, 2024

Mercerdale Park, 7700 SE 32nd St | Mercer Island

www.mifarmersmarket.org

North Bend

This relaxed market enjoys live music and a spectacular Mount Si view. Vendors offer fresh produce, berries, honey, flowers, baked goods, hand-crafted items, and delicious prepared foods. Two playgrounds plus play fields and a covered picnic shelter make this a fun hangout spot. Leashed pets are welcome, too!

June 6 – August 22, 2024: Thursdays, 4pm – 8pm (Closed July 4)

August 29 – September 12, 2024: Thursdays, 3:30pm – 7:30pm

Si View Park, 400 SE Orchard Dr | North Bend

www.siviewpark.org/farmers-market.phtml

Redmond

Going strong since 1976, the Redmond Saturday Market offers a huge selection of vendors and dazzling array of produce, flowers, cheeses, preserves, salmon, tea, and handmade goods such as pottery and soaps. You’ll love the ready-to-eat foods, too.

Saturdays, 9am – 2pm | May 11 – Oct 26, 2024

9900 Willows Rd NE | Redmond

www.redmondsaturdaymarket.org

Renton

Find exclusively Washington-produced fruits, veggies, handmade goods, arts, crafts and more right in the heart of downtown Renton at Piazza Park. Food trucks, live music, and kids’ activities such as the “Healthy Kids Corner” make this a fun spot to liven up your Tuesday.

Tuesdays, 3pm – 7pm | June – Sept, 2024

Piazza Park, 233 Burnett Ave. S | Renton

www.rentonfarmersmarket.com

Sammamish

Each Wednesday, the Sammamish Commons plays host to a variety of local farmers, nurseries, bakeries, artisans, food vendors, and more. Live music and kids’ activities, too!

Wednesdays, 4pm – 8pm | May 15 – Sept 25, 2024 (Closed July 3)

Sammamish Commons, 801 228 Ave SE | Sammamish

www.sammamishfarmersmarket.org

Woodinville

Note the new hours for 2024! Come check out downtown Woodinville’s Schoolhouse District and find produce grown in the state of Washington (and picked fresh for that morning!). You’ll also have an array of boutique baked goods, sauces, cider, artisans, and more to peruse. Check out the calendar for live entertainment, music, demos, and other activities.

Saturdays, 10am – 2pm | May 4 – Sept 28, 2024

13205 NE 175th St | Woodinville

woodinvillefarmersmarket.com

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

How’s the Market? Q1 2024 Review of Seattle Area Real Estate

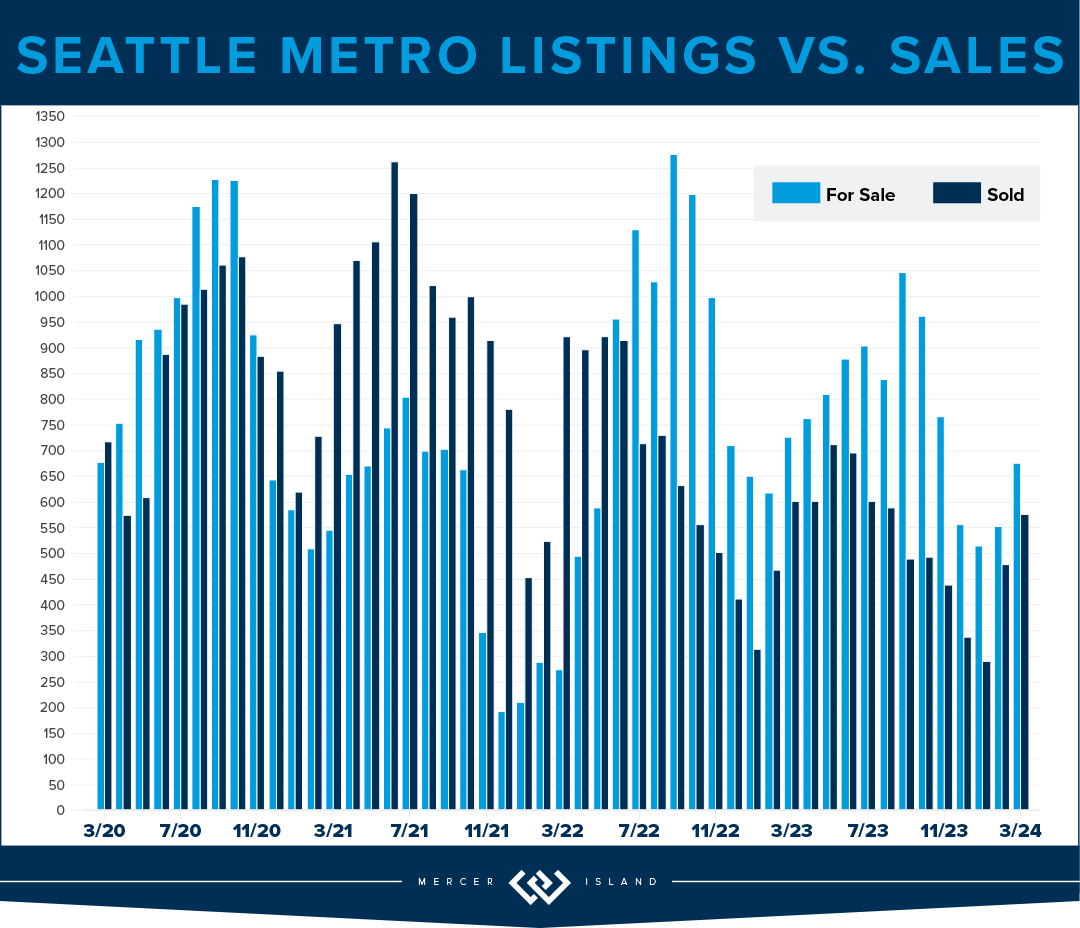

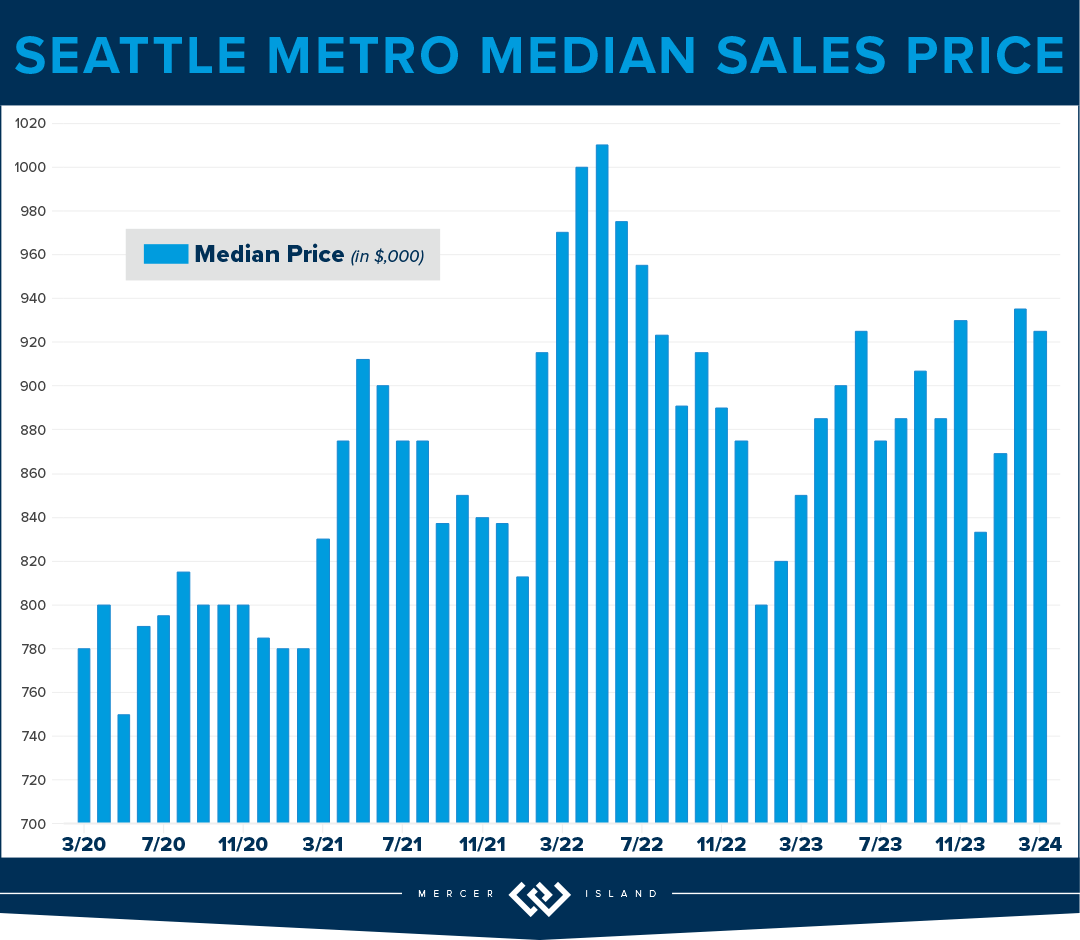

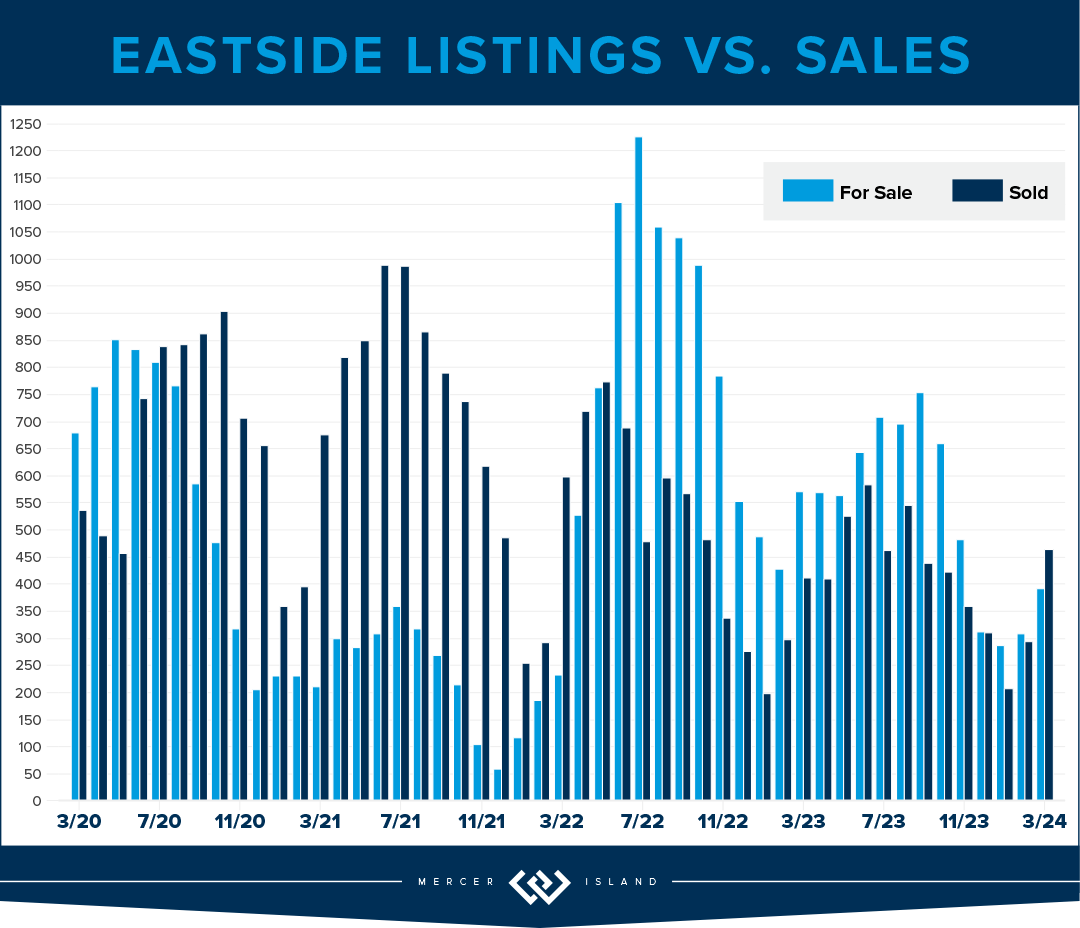

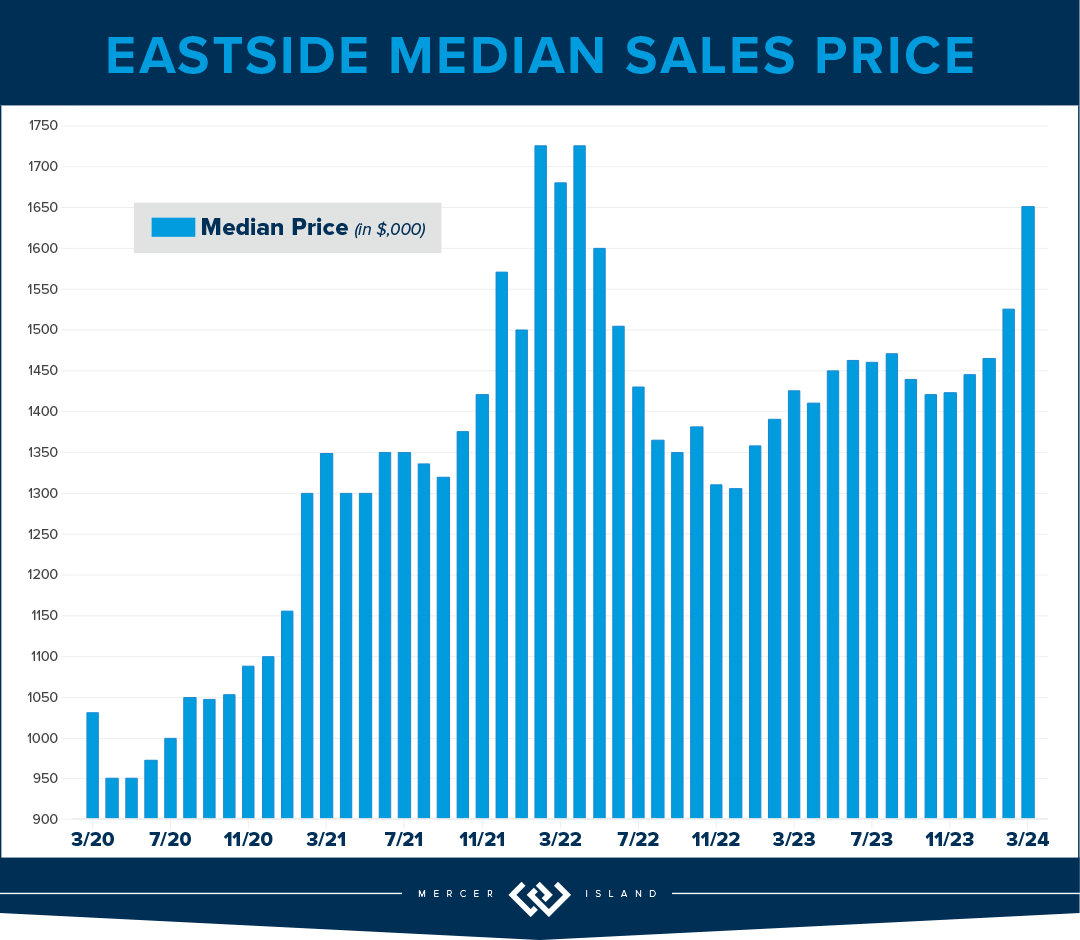

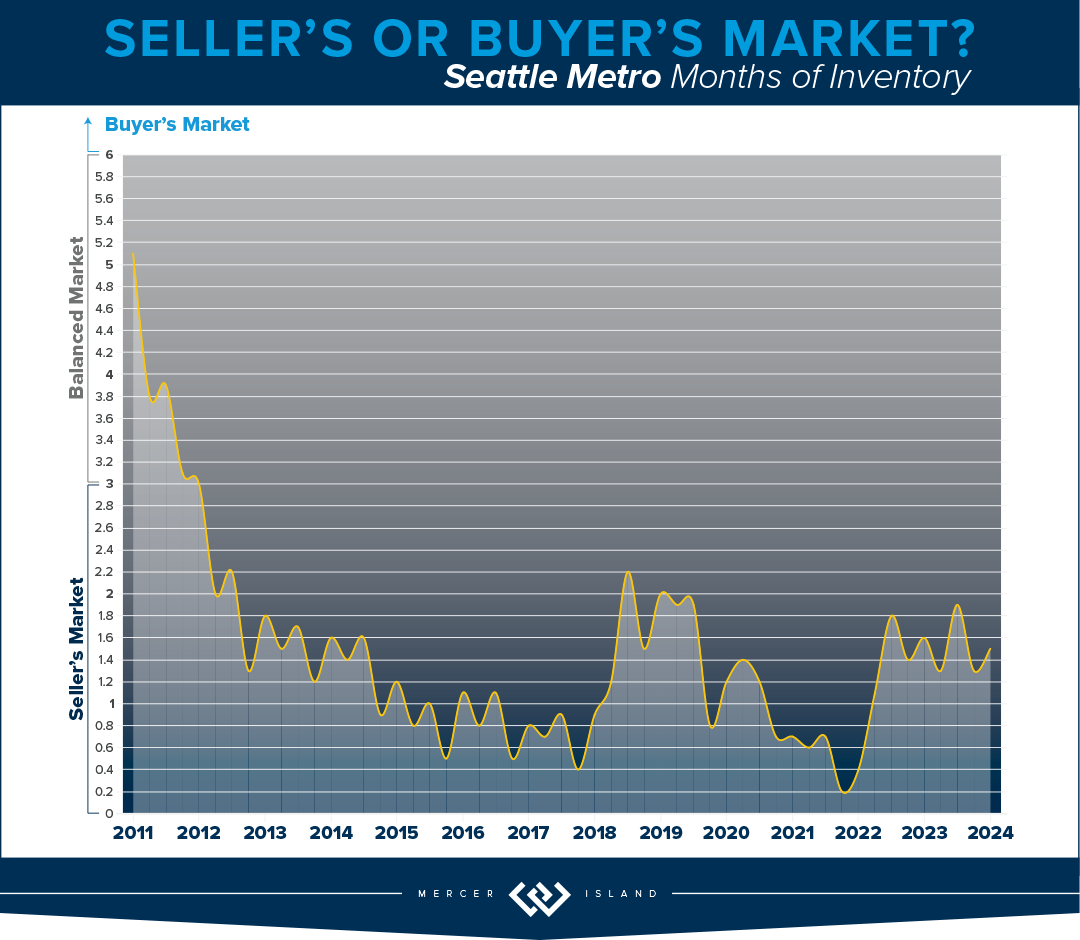

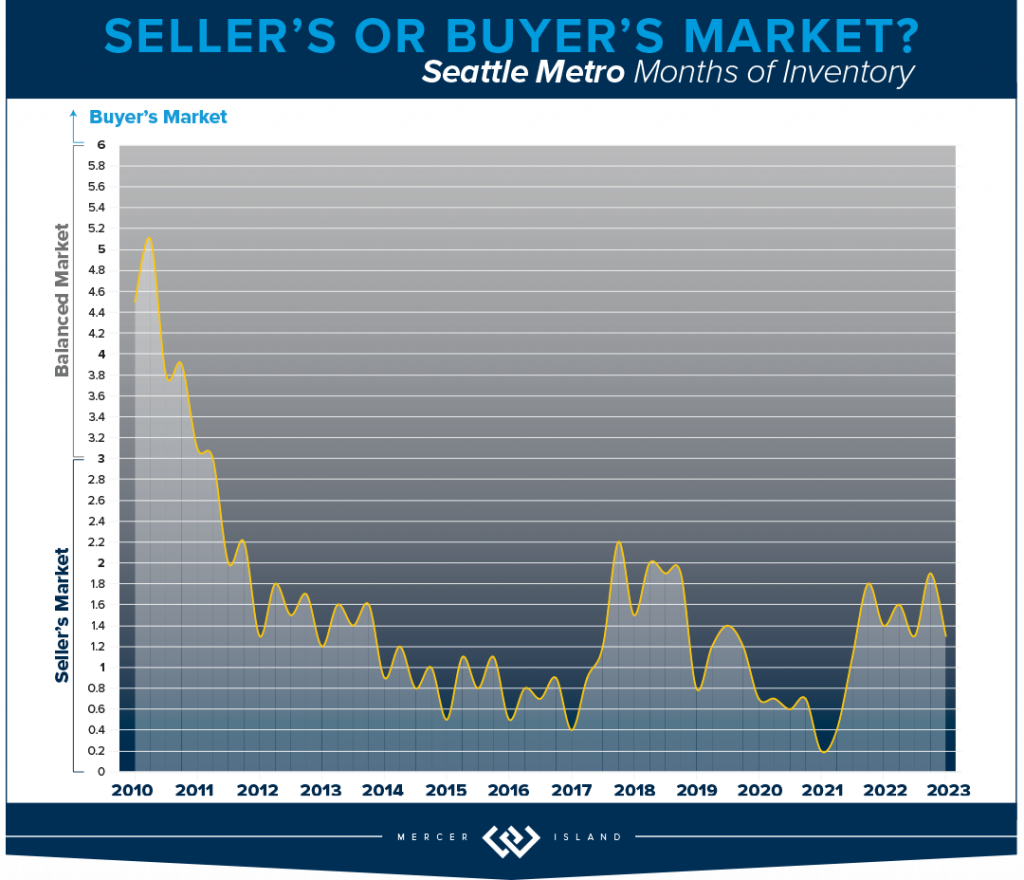

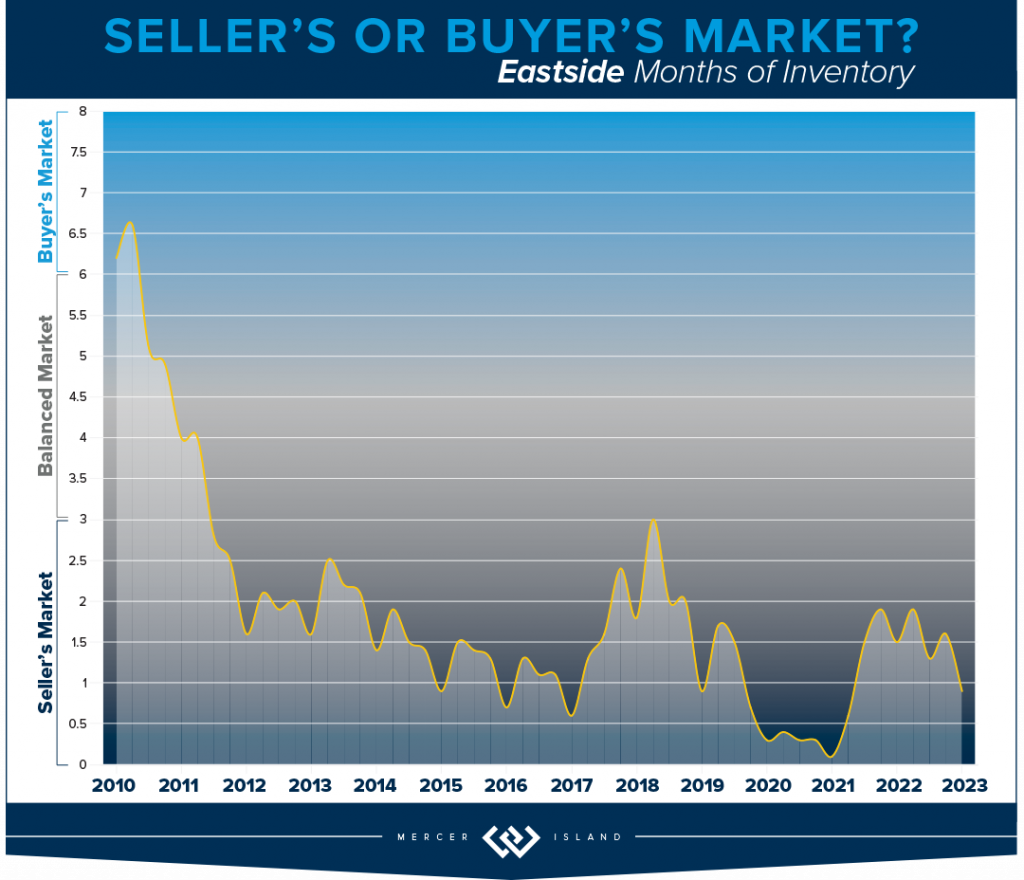

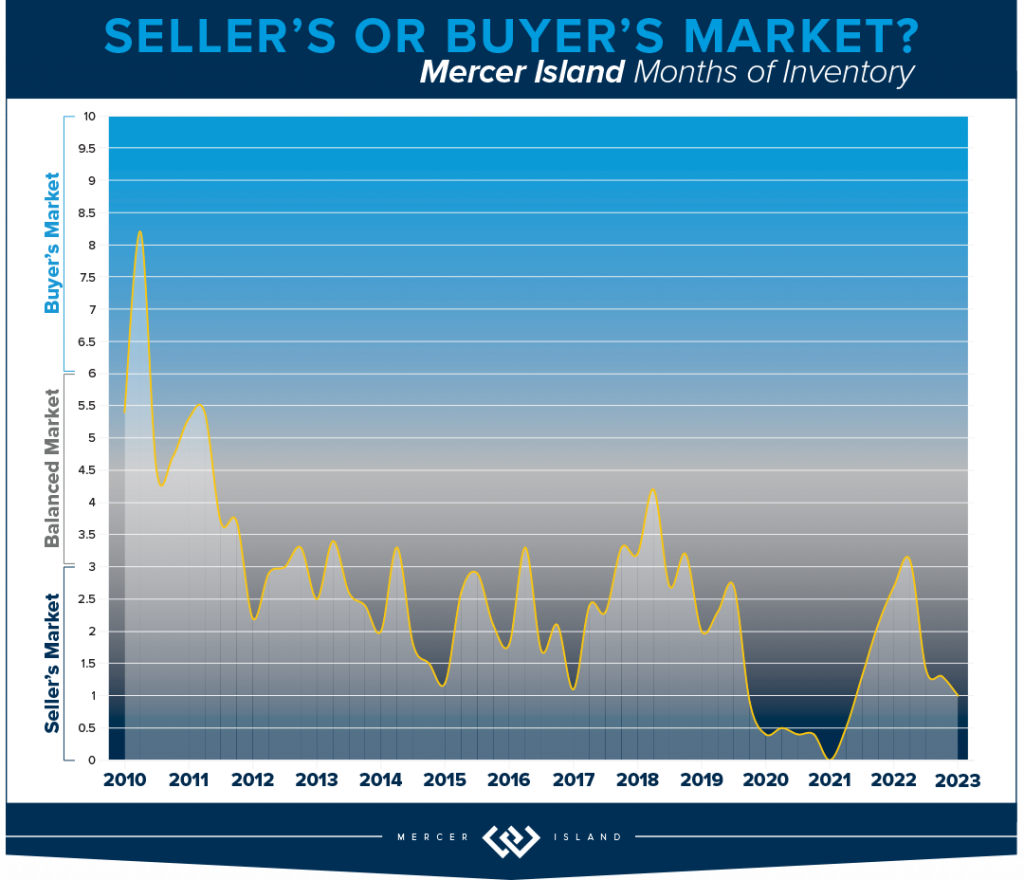

The Seattle/Eastside real estate market is hot and the Q1 stats support the claim; most homes sold in the first 10 days and either at or above their listed prices. Eastside median sales prices saw double-digit gains of 14% compared to this time last year, while Seattle was close behind with a 9% price bump. We saw more new listings this year than in Q1 of 2023; however, this was not enough to tip the scales and we remain staunchly in a seller’s market for the foreseeable future. The good news for buyers is that interest rates have stabilized and more sellers are jumping off the fence to list their homes. Competition for prime properties will remain high, however, so buyers should be prepared to take a leap of their own when the right home presents itself.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

It’s safe to say the spring market hit early in Seattle! We’ve seen a 9% rise in median home price and 69% of listings selling at or above list price, all while interest rates are in the mid 6s. We are bullish on the year to come. Overall sales are down 3% YoY, which is slightly troubling because Q1 2023 saw a 28% dip from the previous year. If you dig a little deeper it seems that the north end (Kenmore and Lake Forest Park) saw a 42% reduction in overall sales with a 30% increase in median price.

Prices are up across the board. The largest jumps in median price are in Lake Forest Park and North Seattle (30% and 23% respectively), while the highest $/sq.ft. jumps were in Madison Park and South Seattle. 56% of all homes on the west side sold in the first 10 days and for an average of 105% of list price. This is a great indicator that the market will continue to be strong in Q2.

The total number of new listings remains relatively low in the city, when compared with years past. This is to be expected as current homeowners stay put to enjoy their cozy sub-3% interest rates. We hope that equity will begin burning holes in their pockets soon—the market could use the inventory. If you’ve been thinking about buying, this could be your year! Get pre-approved and be ready to jump when you see the right home come available.

If you’ve thought about selling your home, it may be a good year to do so. As is typical in the early stages of appreciating cycles, buyers are brought off the fence by “the house” popping up—and they’re paying premiums for cream puff properties. Interest rates have stabilized and experts say they may become even more favorable as the year progresses. Check with your agent about your own unique situation.

Click here for the full report and neighborhood-by-neighborhood statistics!

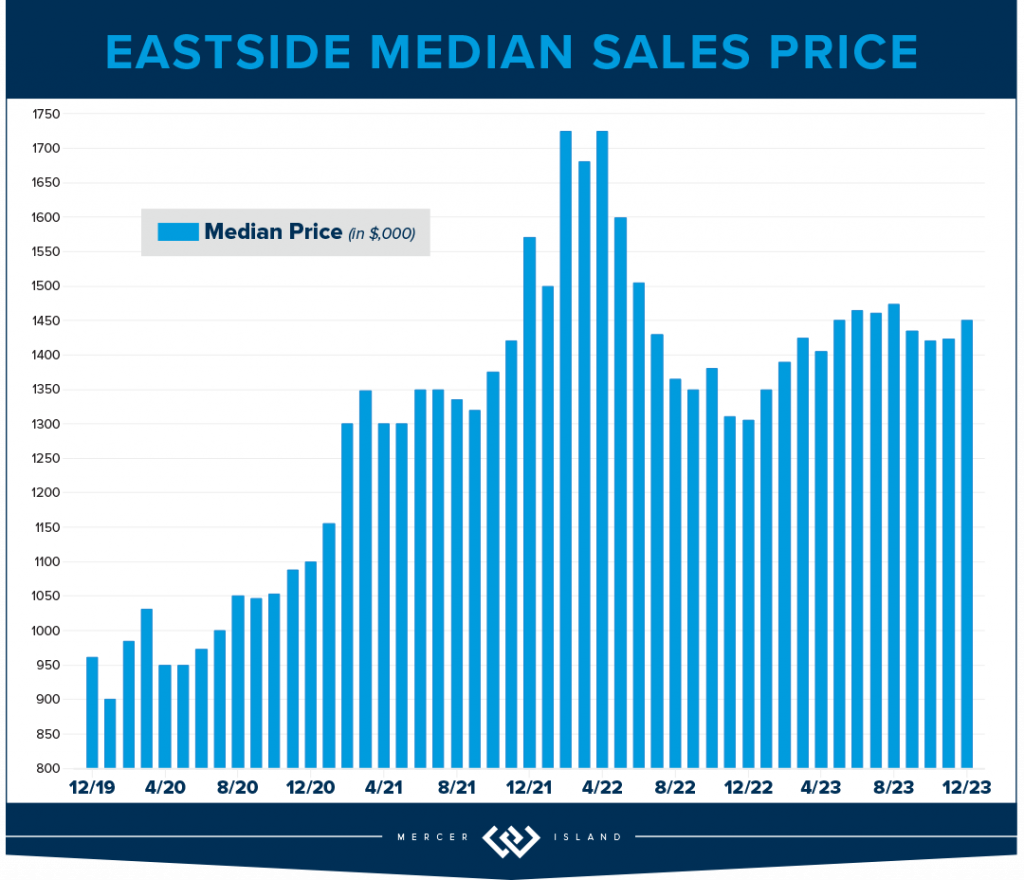

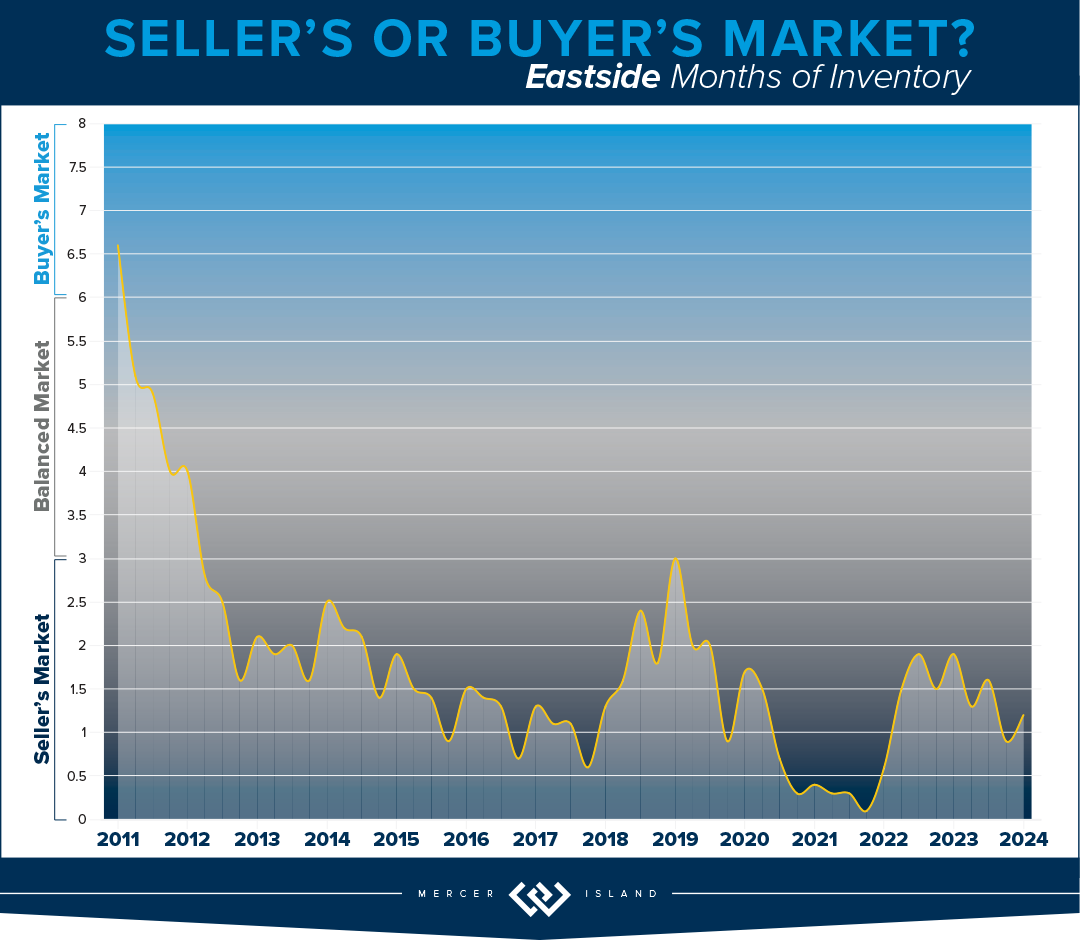

EASTSIDE

The numbers are in and the statistics reflect what agents and consumers have felt thus far in 2024—the market is hot. Median home prices on the greater Eastside are up 14%. 65% of all listed homes sold in the first ten days for an average of 105% of list price. The communities that have posted the largest gains are Kirkland and the area South of I-90 (32% and 21%). Redmond and West Bellevue reported much more conservative median price increases at 4%. The total number of pending homes was up 18% YoY, which bodes well for continued price gains.

If you’re in the market to purchase a home on the Eastside we are hopeful for more inventory this year. Even though rates are still nowhere near their all-time lows, which was the anecdotal explanation for lack of inventory in 2023, it seems that a Q1 sales boom is enough to help potential home sellers feel bullish on 2024. This means you can also expect competition for the prime properties. Our best home buying advice: do your research, act with confidence, and remember real estate is a long-term investment.

If you’re a homeowner thinking about a home sale in 2024, Q2 could be the perfect time. Shoppers are out in droves and they’re prepared to pay top dollar for quality product. The steep jump in median home price should continue at least into Q2. The only threat in Q3 and Q4 is what could shape up to be a distracting election cycle. Though, the election year is likely what is keeping downward pressure on rates. Our best home selling advice: follow your agents’ guidance on timing as it’s sure to be a volatile year. Prep hard and price conservatively. It will all work out in your favor.

Click here for the full report and neighborhood-by-neighborhood statistics!

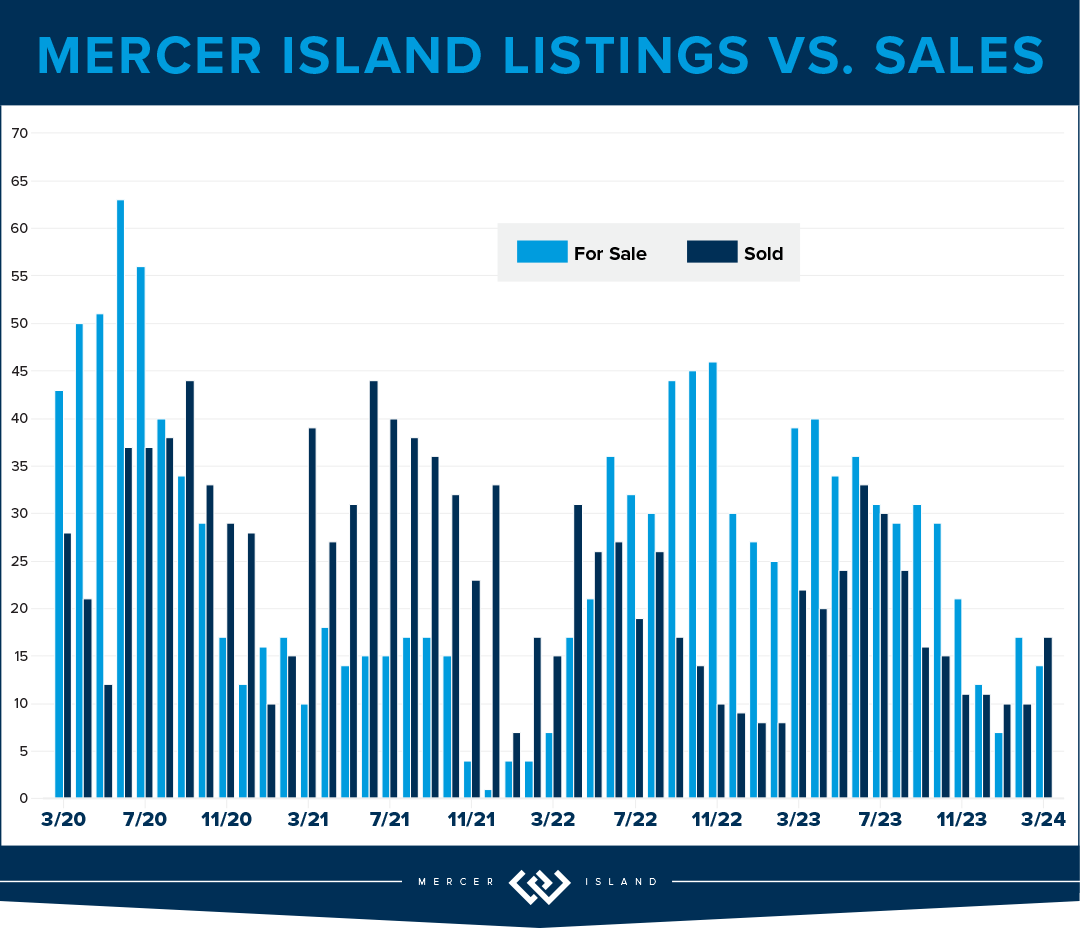

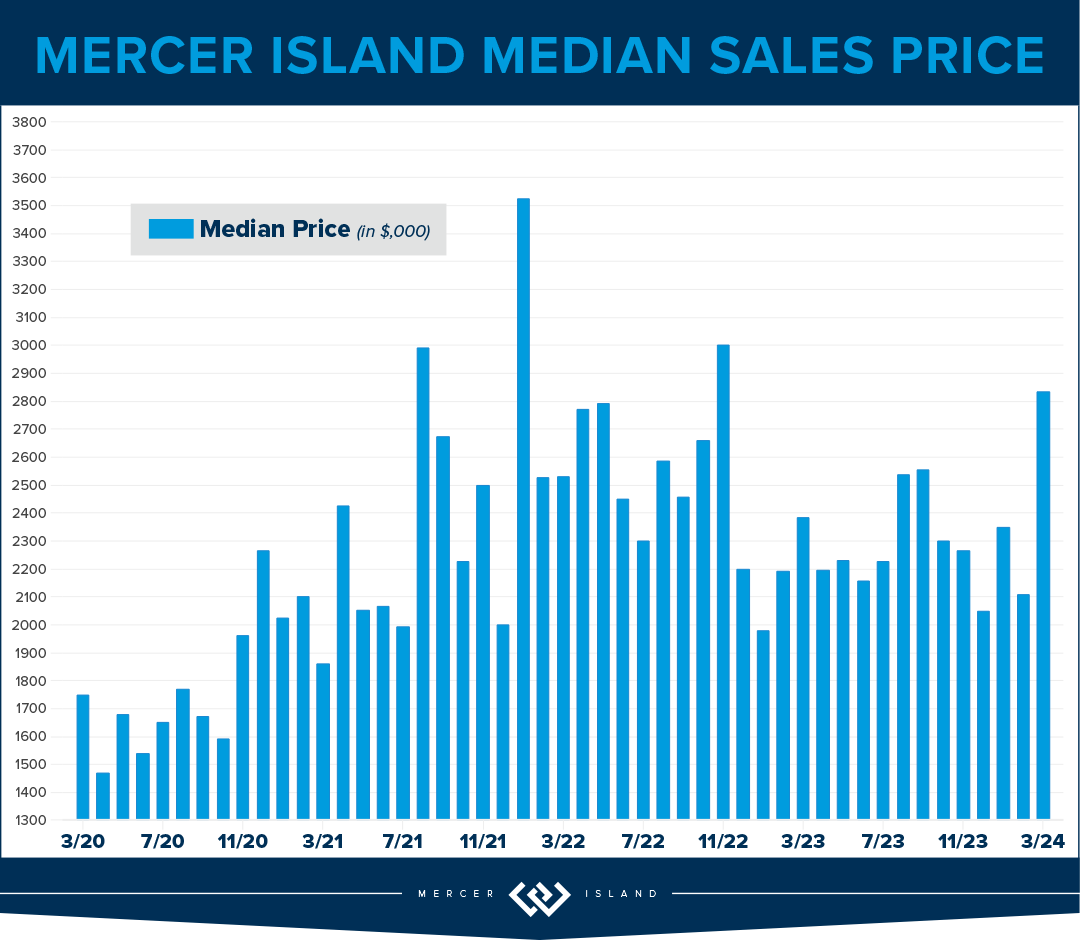

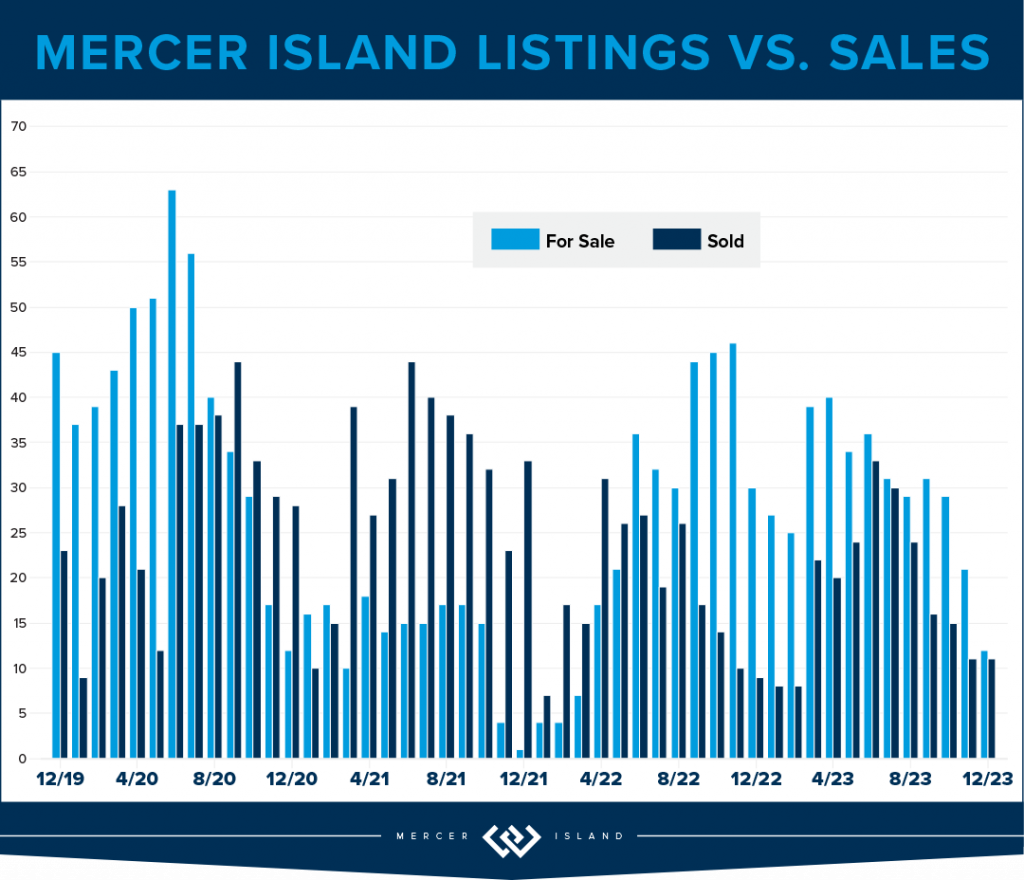

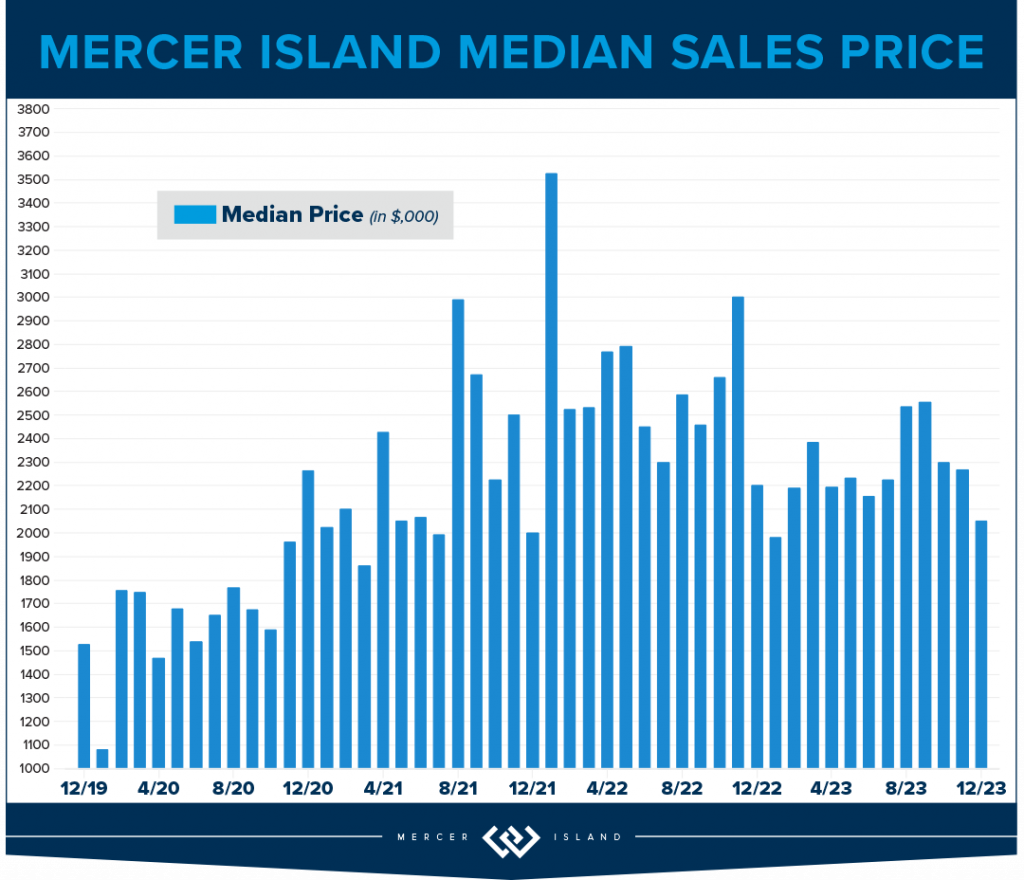

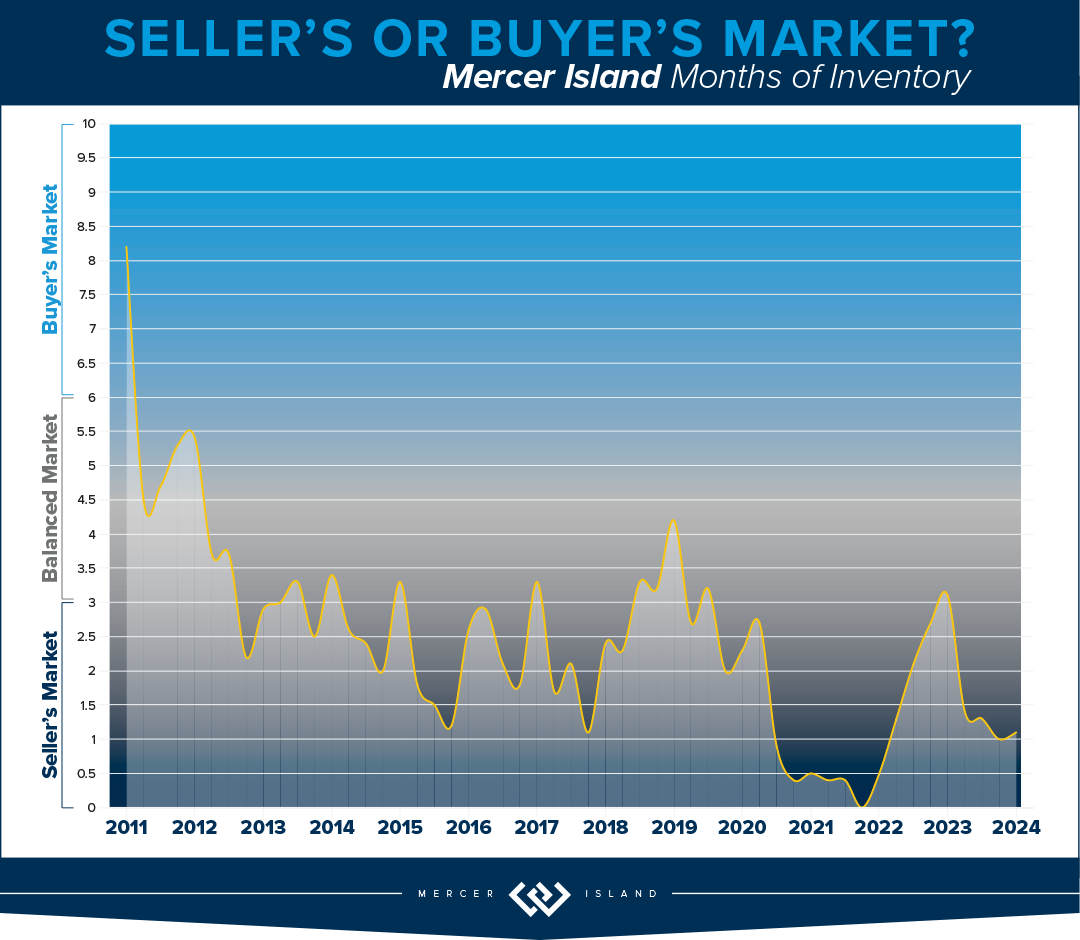

MERCER ISLAND

What a difference a year makes! In Q1, Mercer Island’s median sale price is already up 13% over a relatively flat year in 2023, rising from around $2,200,000 to $2,520,000. We’re seeing shorter market times and multiple offers; spring has sprung on the Island. With 59 new listings and 37 closed sales inventory appears to be tracking with what we’ve seen in Q1 in years past. That said, condos continue to lag behind single family: only 6 closed sales all quarter. The average price per square foot is $535—about where it’s been tracking since it jumped from $485 in Q1 of 2021. Not a lot of shocking change here.

If you’re in the market to purchase a home on Mercer Island you can expect better inventory this year than last year. Even though rates are still nowhere near their all-time lows, which was the anecdotal explanation for low inventory in 2023, it seems that a Q1 sales boom is enough to help potential home sellers feel bullish on 2024. This means you can also expect competition for the prime properties. Our advice: do your research, act with confidence, and remember real estate is a long-term investment.

If you’ve been thinking about selling your home to upgrade or downsize, Q2 could be the perfect time. Shoppers are out in droves and they’re prepared to pay top dollar for quality product. The steep jump in median home price should continue at least into Q2. The only threat in Q3 and Q4 is what could shape up to be a distracting election cycle. That being said, the election year is likely what is keeping downward pressure on rates. Our advice: follow your agents’ guidance on timing as the situation develops this year. Prep hard and price conservatively. It will all work out in your favor.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

It seems a healthy start to 2024 in the condo market. While the Q1 of 2023 numbers were down across the board, Q1 of 2024 is looking up with a combined rise in price of 15% and 34% more fresh new listings (YoY).

On the Eastside there were 202 active listings available at the end of the quarter, while 501 homes accepted offers during the quarter. This was the highest number of pendings in one quarter in the last two years! To real estate professionals, “pendings” are the canary in the coal mine of the market. A spike in pendings is a predictor that the market is heating up.

In Seattle new listings doubled from Q4 2023 (534) to Q1 2024 (1019), while pendings and solds are up 20% YoY. If you’re shopping for a condo, keep an eye out for enticing new inventory in Q2. 42% of Seattle condos sold in the first 10 days and for 100% of the list price. 44% of condos took more than 30 days to sell, though they still commanded 97% of their list price. To me this means that pricing is more important than ever in determining your outcome.

Now it’s time for me to stand on the home ownership soap box. There seem to be a lot of headlines about the unaffordability of single family homes. While there is no denying how expensive it is, there is a missing piece to the story: at some point during the prolonged period of “cheap money” first time buyers forgot about the first rung of the property ladder. CONDOS create an affordable option to start building wealth at a younger age. It’s an important real estate product that has been overlooked. We are hopeful that enterprising young homeowners return to the condo market in droves this next real estate cycle.

Check out area-by-area details the full condo report.

WATERFRONT

Seattle and the Eastside each had 6 waterfront sales in the first quarter, with 4 out of the 6 sales for both areas closing at or above the listing price (including one unlisted sale). All of the Eastside’s listed sales were on the market for only 8 days or less. Lake Sammamish was close behind with 5 sales (however 4 out 5 sales went below the asking price) and Mercer Island lagged behind with just 1 sale. Medina boasted the largest waterfront sale, a newer home on 117 feet of lakefront with a mind-blowing 13,590 interior square feet and 1.5 acres of grounds. The most modest sale was for a Lake Forest Park home on just 40 feet of waterfront—it sold almost immediately for 7% above its asking price.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Brooke Davis and Emerald City Snap. Eastside cover photo courtesy of Team RAREnorthwest and Clarity Northwest Photography. Mercer Island cover photo courtesy of Nancy LaVallee and Clarity Northwest Photography. Condo cover photo courtesy of Michael Fleming and Clarity Northwest Photography.

Moving Day: Checklists & Tips to Stress Less

Ah, moving day…that magical mix of excitement, chaos, and occasional panic. Whether it is across town or cross-country, the reality of packing, moving, and setting up a new home can become overwhelming. No list can make a move “stress free,” BUT planning ahead and staying organized can help make your move a little smoother. Here is a printable checklist along with our tips for the big day:

Getting Started

Once you know your prospective move date, set up a quick timeline to make sure you can get all the important tasks done and ready in time for your move.

Consider how much stuff you have by doing a home inventory. This can help you decide whether you need to hire movers to help you or if you will be managing your move on your own. Many moving companies supply inventory lists to help you assess the size of truck you will need. You can use your list as double duty for insurance purposes later (try using this helpful home inventory app from the National Association of Insurance Commissioners).

As soon as you decide how you will be moving, make your reservations. In general, moving companies and truck rental services are over-booked at the beginning and very end of the month. If you are planning on hiring a moving company, contact a few in your area for a price quote. To find companies ask your real estate agent, family, or friends, and consult online reviews. It is also a good idea to request a quote and compare companies.

Preparing for Your Move

- Moving is a great opportunity to get rid of clutter, junk, or outdated items. Set aside some time to sort through your closets, storage spaces, files, drawers, and more. Go through cluttered areas and organize items by “keepers”, “give-aways” and “garbage”. You will have less to pack and an opportunity to update after you move. Contact a local nonprofit organization for your donations; some will arrange to pick up larger donations like furniture. If you have items of value, eBay or craigslist are good options.

- Changing your address is one of the more tedious tasks in the moving process. You will need to change your address with the United States Post Office. You can find the online form here: Movers Guide.

You will also need to change your address with each account you have. Here is a list to get your started:

- Employers

- Bank(s)

- Utilities (Electric, Water/Sewage, Oil/Gas)

- Cable/ Telephone

- Cell phone service

- Credit Cards

- Magazine subscriptions

- Insurance companies (auto, home/renters, health, dental, vision, etc.)

- Pharmacy

- Other personal services

Let the Packing Begin

Before you start packing, it may help to visualize where everything you have will go. Perhaps furniture will fit better in a different room? Consider the floor plan of your new home and figure out what will go where. This will aid in packing and labeling as you box everything up.

Use a tool like floorplanner.com to plan where furniture and items will go.

When it comes to packing you have some options. You can work with a service that provides reusable boxes for moving or you can reuse or purchase cardboard boxes. Make sure you have enough boxes, packing tape, dark markers, and packing paper.

Pack rooms according to your floor plan. Label boxes with contents and room. This will make it easier to unpack your home, knowing where everything is going.

Real Simple magazine has some great tips on packing for your move.

If you have to disassemble any of your furniture, make sure you keep all the parts and directions together. Make sure you set aside your necessities for the day you move. Being tired and unable to take a shower or make your bed can be hard at the end of a long moving day. Here are some ideas of what you may like to pack in your “day-of-move” boxes:

- Clean linens for the beds, pillows and blankets

- Clean towels

- Shower curtain, liner and hooks

- Toiletries, hand soap, tooth brush, etc.

- Disposable utensils, cups, napkins, etc.

- Rolls of toilet paper

- Snacks and water

- Change of clothes

- Tools for reassembling furniture, installing hardware, and hanging photos

Making Your Move

- Come up with a game plan with your family, so everyone has a role and a part to play

- Once the house is empty, do a once over on your old place to make sure it is clean for the next owners/occupants. Here is a useful checklist for cleaning.

Warming Your New Home

Once you have settled into your new home, warm it up by inviting friends and family over to celebrate. Here is a great infographic about housewarming traditions and symbolism. Announce your move to far-away friends and family through moving announcements to make sure you stay on the holiday card mailing list.

Ready to make your move? Reach out to get started.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

Remodeling Projects to Avoid When Selling Your Home

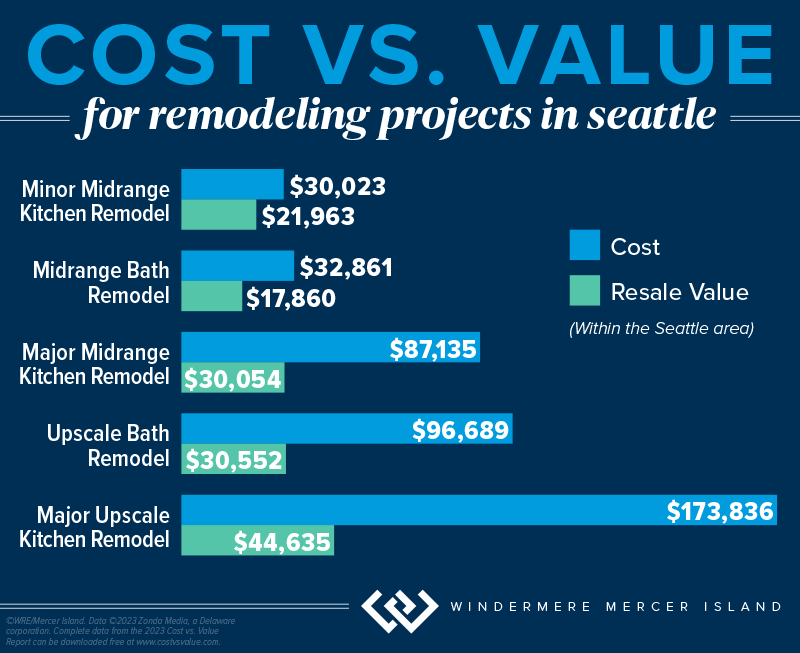

It’s common for homeowners to feel compelled to remodel their homes before they sell. Renovating the spaces in your home can increase its value and help you compete with comparable listings in your area. However, some remodeling projects are more beneficial than others as you get ready to hit the market. Always talk to myself or another local agent to determine which projects are most appealing to buyers in your area.

When preparing to sell your home, you want to strike the right balance of upgrades. Making repairs and executing renovations will attract buyer interest, but you don’t want to dump so much cash into remodeling that you won’t be able to recoup those expenses when your home sells.

So, how do you know where to focus your efforts? Your agent is a vital resource in understanding your specific situation—I typically offer guidance to my clients on remodeling efforts that will help sell their home for the best price. Here are a few projects sellers will want to keep off their to-do lists for the best return on investment…

Major, Pricey Upgrades with Long Timelines

For any remodeling project, an analysis of your home’s value will be key to helping you determine its risk/reward potential (reach out if you’d like one for your home). This dynamic is especially important for big remodels and home upgrades, due to their higher costs. The latest Remodeling Cost vs. Value Report (www.costvsvalue.com)1 data for the Seattle area shows a generally negative return on investment for major, upscale remodeling projects—they only recouped about 25%-30% of their cost…

These projects come with hefty price tags and longer timelines than minor repairs and upgrades, which can complicate factors as you prepare to sell, especially if you have a deadline to get into your new home. They have the potential to temporarily displace you from the property, meaning you and your household may have to find somewhere else to stay until the project is complete.

The Bottom Line: To go through with a major home upgrade before you sell, its schedule must fit with your moving timeline. It should also align with buyer interest in your local market. If the project doesn’t meet these criteria, it should be avoided.

Non-Permitted Projects & Building Code Violations

Before you decide to finish out the basement or make changes to your home’s wiring/structure/mechanical systems, it is important to make sure you obtain the proper city, county and/or state permits + inspections. Non-permitted square footage does not reflect on the county tax record and can lead to low appraisals when the buyer tries to get a loan. Obtaining permits also helps ensure your alterations meet the current building code—otherwise, you may face legal exposure should they create a safety hazard. Furthermore, any non-permitted remodels must be disclosed to the buyer on your Form 17 if you live in Washington State. The buyer’s mortgage lender may also have stipulations saying that the loan may not be used to purchase a home with certain features that aren’t up to code, which could lead to them backing out of the deal.

If you’re selling an older home, you’re not obligated to update every feature that may be out of code to fit modern standards. These projects are often structural and require a significant investment. If the violation in question was built to code according to the regulations at the time, then a grandfather clause typically applies. However, you’ll need to disclose these features to the buyer.

Trendy Makeovers and Upgrades

Lastly, it’s best to avoid remodeling projects that target a specific trend in home design. Trends come and go. Timeless design is a hallmark of marketable homes because it appeals to the widest possible pool of buyers. Keep this in mind when staging your home as well. Creating an environment that’s universally appealing and depersonalized allows buyers to more easily imagine the home as their own.

Wondering which remodeling projects might help your home sell? Reach out any time…I’m never too busy to discuss your options and offer advice based on the current market.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

1©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

Adapted from an article that originally appeared on the Windermere Blog, written by: Sandy Dodge.

Tax Benefits Every Homeowner Should Know About

It’s tax season again, but being a homeowner might just make it rain at refund time. Check out the tax-deductible expenses, exemptions, and credits below. Whether you own a house, condo, or mobile home, they can save you big money when you file. Just be sure to compare your total itemized deductions against the standard deduction and see which is higher (you’ll have to choose between standard OR itemized on your return). It’s also good to know what you can’t deduct before you land in hot water with the IRS…

Mortgage Interest

A house payment is comprised of two parts: principal and interest. The principal goes toward reducing the amount you owe on your loan and is not deductible. However, the interest you pay is deductible as an itemized expense on your tax return. You can generally deduct interest on the first $750,000 of your mortgage (or $375,000 each if you’re married filing separately) if you purchased your home after December 15th 2017. Those who purchased earlier (10/14/1987 – 12/15/2017) can deduct interest paid on up to a $1m mortgage.

Property Taxes

You can deduct up to $10,000 of property taxes you paid (or $5,000 if you’re married filing separately). If you have a mortgage, the amount you paid in taxes will be included on the same annual lender statement that shows your loan interest information. If you paid the property taxes yourself but don’t have receipts, you should be able to locate the total tax amount on your county assessor’s website.

Home Improvements

Making improvements on a home can help you reduce your taxes in a few possible ways:

- If using a home equity loan or other loan secured by a home to finance home improvements, these loans will qualify for the same mortgage interest deductions as the main mortgage. Only the interest associated with the first $100,000 is deductible (and if you’ve already maxed out the interest deduction on your main mortgage, you won’t be eligible for any additional deduction for this loan).

- Tracking home improvements can help when the time comes to sell. If a home sells for more than it was purchased for, that extra money is considered taxable income. However, you are allowed to add capital improvements to the cost/tax basis of your home thereby reducing the amount of taxable income from the sale. Keep in mind that most taxpayers are exempted from paying taxes on the first $250,000 (for single filers) and $500,000 (for joint filers) of gains.

- Home improvements made to accommodate a person with a disability (yourself, your spouse, or your dependents who live with you) may be deductible as medical expenses. Examples include adding ramps, widening doorways/hallways, installing handrails or grab bars, lowering kitchen cabinets, or other modifications to provide wheelchair access.

- If you live in Washington State and apply with your county prior to construction, you may be able to get a 3-year property tax exemption for major home improvements (including an ADU or DADU) that add up to 30% of the original home’s value.

Home Office Deduction

If you run a business out of your home, you can take a deduction for the room or space used exclusively for work as your principal place of business. This includes working from a garage, as well as a typical office space. Unlike most of the other deductible expenses, you can deduct home office expenses even if you opt to take the standard deduction.

This deduction can include expenses like mortgage interest, insurance, utilities, and repairs, and is calculated based on “the percentage of your home devoted to business use,” according to the IRS.

Home Energy Tax Credits

For homeowners looking to make their primary home a little greener, either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit can help offset the cost of energy efficiency improvements. Even better, these are credits, which means they directly lower your tax bill.

- Energy Efficient Home Improvement Credit: 30% of the cost for qualified high-efficiency doors, window, insulation, air conditioners, water heaters, furnaces, heat pumps, etc. Maximum credit of $1,200 (heat pumps, biomass stoves and boilers have separate max of $2,000).

- Residential Clean Energy Credit: 30% of the cost for adding qualified solar/wind/geothermal power generation, solar water heaters, fuel cells, and battery storage.

What You Can’t Deduct:

- Mortgage Insurance (this is a change as of 2022)

- Title Insurance

- Closing Costs

- Loan Origination Points

- Down Payment

- Lost Earnest Money

- Homeowner’s Dues*

- Homeowner’s/Fire Insurance*

- Utilities*

- Depreciation*

- Domestic staff or services*

*Unless it’s related to your home-office deduction—contact your tax pro to see if it’s a qualified deduction for you.

Do you have a low-income, disabled or senior homeowner in your life? Check out this article on King County property tax relief.

Psst…every homeowner’s financial situation is different, so please consult with a tax professional regarding your individual tax liability.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

Adapted from an article that originally appeared on the Windermere Blog, written by: Chad Basinger.

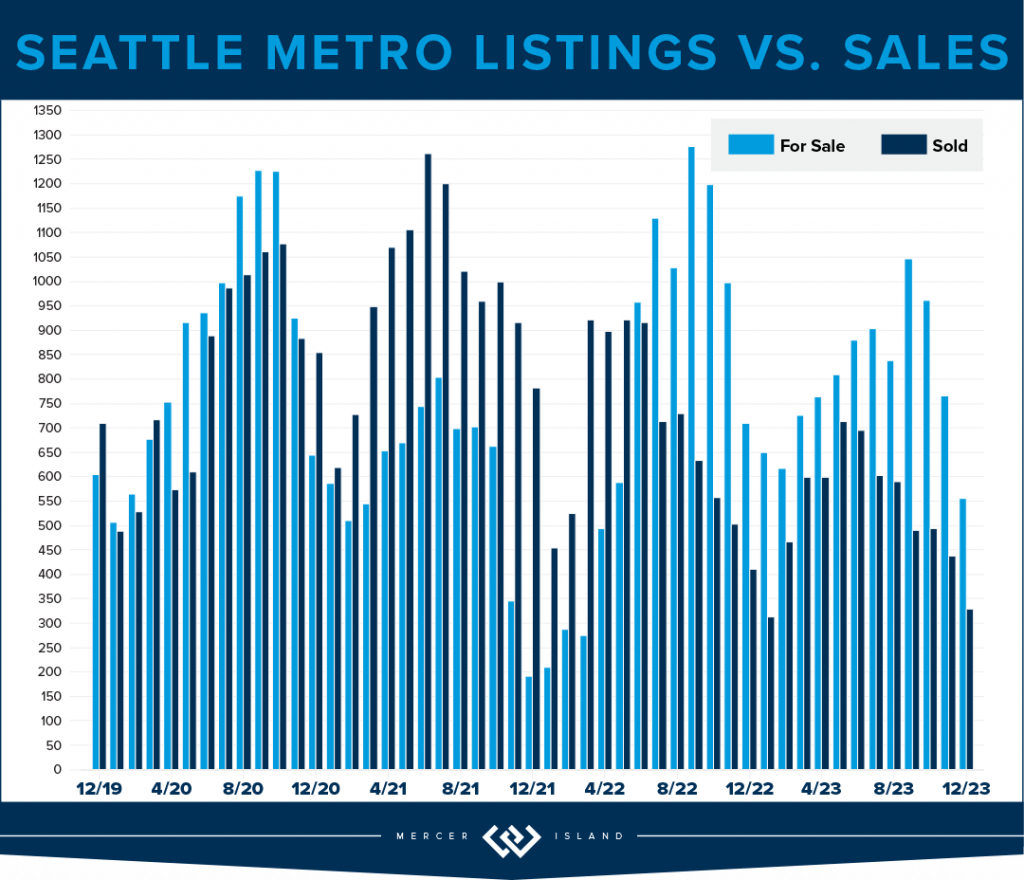

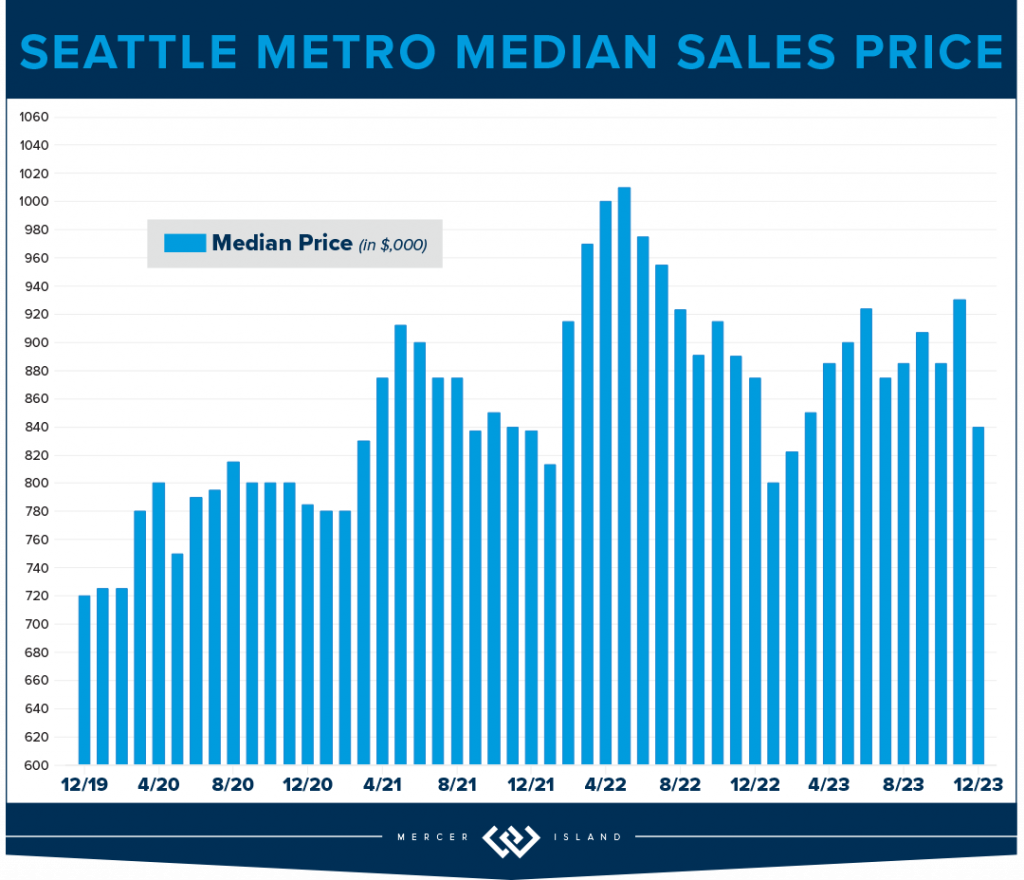

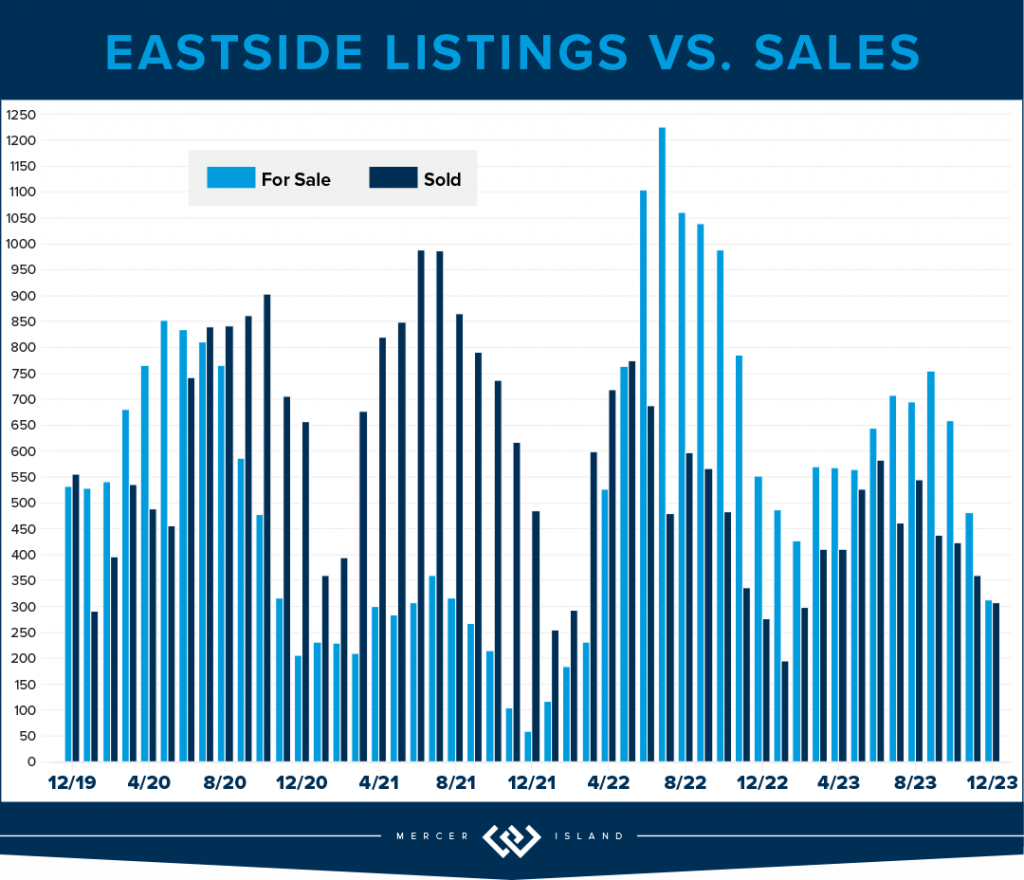

How’s the Market? An Annual Review of Seattle Area Real Estate

Median home sales prices across the region saw a year-over-year dip compared to 2022, with prices settling just above their 2021 levels. That being said, most homes still sold within the first 10 days on the market and either at or above the listing price. Today’s higher rates, in concert with constricted inventory, have slowed the total number of sales. Should rates ease like experts are predicting, however, we will see more people enter the market and hopefully more listings will follow. (Read more about that in our full 2024 forecast).

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

Would you like the good news or the bad news? Bad: Overall home prices slid in the city by 7%. Good: 57% of all homes sold in the first 10 days and for 104% of list price. While we may have backed off of our head spinning pandemic list/sale percentages, we’re still going strong. To us what this means is: if you’re considering selling there is probably a buyer ready and waiting to make you an offer. It just won’t be quite as lucrative as it might have been in 2022. It could be a lot worse given the high cost of money in 2023. Homeowners certainly came out ahead and Seattleites have our chronically low inventory and stable job market to thank for this!

We finished the year with sales down 23%, a figure made a lot less scary by the fact that listings were also down city wide by 24%. North Seattle east of I-5 saw the most stable prices, only losing 2% at a median price of $976,000. Queen Anne/Magnolia lost 10%, closing out the year at $1,263,000. It’s also interesting to note that 65% of homes sold for list price or better. This means we have mostly well counseled homeowners with reasonable expectations of what the market will bear.

If you’re in the market for a new home in 2024, Q1 is a great time! Inventory hasn’t been this low since 2012. If the cost of money goes down—as many experts are predicting—and more people decide to purchase, it could get very competitive very quickly! Beat the rush!

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

The Eastside median sales price was down by 4% as we closed out 2023. This is in large part due to the interest rates. It certainly isn’t supply and demand: Total listings were down 29% while sales only dipped 18% YOY. That’s staggering. Buyers and Sellers did not seem to be aligned in their estimation of the market: only 55% of homes sold for at or above list price while 45% needed a reduction or negotiation prior to accepting an offer. While this sounds balanced, it’s out of the norm compared to our historic data.

Sammamish was the strongest overall area with a whopping 1217 sales (25% of the total 4954) and the lowest median price dip of 3%; $1,400,000 in 2023 v. $1,450,000 in 2022. Mercer Island was the hardest hit with a 12% drop in median price to $2,239,000—the lowest since 2020. Corrections are healthy for the long-term health of a real estate market. We’re not sure how long this one will last; all signs are pointing to continued low inventory. It seems to be a game of chicken with the interest rates that could lead to massive pent-up demand.

If you’re in the market for a new home in 2024, Q1 is a great time! Inventory is at its absolute 15 year low (6,140 listings compared to a high of 10,880 in 2010) which means we are poised for a market flip. If the cost of money goes down—as many experts are predicting—and more people decide to purchase, it could get very competitive very quickly! Beat the rush!

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

The Island saw just 289 new listings last year, only 60% of the peak 488 in 2013. There are some numbers that show we had very realistic homeowners in 2023: a 78% absorption of listings, (222 sales, up from 218 in 2022) and 98% list/sale price. When buyer and seller expectations meet, magic happens. The median price in 2023 was $2,239,000 back to around the same level as 2021—if you remember, this was a 30% increase from $1,700,000 in 2020.

Condos on the Island are off 8% to $620,000 from the 2022 high of $674,000, this is a strong showing. For the previous 4 years (2018-21) median prices were in the $500’s. There were only 33 sales Island-wide, the lowest number of total sales in 15 years. Listings were down as well: the lowest level since 2012. The metrics show that the market was strong, even with the dip in median sales price: 19 days on market, 99% list/sale price ratio, on average only 4 listings were active at one time. These are all signs of a constricted inventory/sellers’ market, which is what will eventually drive prices higher.

All in all, MI is holding strong to the price gains made during the pandemic. We are bullish on our market in 2024 as interest rates are easing. Time will tell.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Whew! What a year! The major condo headline for both Eastside and Seattle condos: Prices hold steady while demand dips 25%! While this is sensationalized, it’s true. Likely due to the fact that inventory was also down by 20%, which means that supply and demand remained aligned and shielded homeowners from what could have been a massive hit to their bottom lines.

On the Eastside, when the dust settled, prices are down by 1%. The largest drop in median price was East Bellevue losing 11% while Kirkland soared above all other neighborhoods with double digit gains (up 19%). Other areas of note: West Bellevue topped the charts with a median sale price of $880,000! This is higher than the $876,000 residential median sale price in the city of Seattle.

Speaking of Seattle, the condo market in the city reminds us of The Little Engine That Could. Chugging merrily along despite having the odds stacked against it: I think I can! Overall, the city posted a 5% gain year over year with record high median sales price of $546,000. Downtown saw the highest overall unit volume at 439 total sales, while Greenlake/Ballard boasted the highest overall gain in median price at 15% appreciation. All good news, finally.

Check out area-by-area details the full condo report.

WATERFRONT

While Seattle and the Eastside both posted fewer waterfront sales in 2023 than in 2022, Lake Sammamish saw a big 40% year-over-year jump in sales. Mercer Island’s sales increased by a more modest 10%.

The highest waterfront sale of 2023 was $20 million for a breathtaking Evergreen Point estate on 115 feet of prime low-bank shoreline. Listed by Windermere and truly unique with a custom home designed by Hal Levitt, it sold its first day on the market (and well above the $18.5m asking price!).

The most modest waterfront sale was a 1,749 sq. ft. Lake Sammamish home sold by the owner for $1.62 million. It featured 25 feet of lakefront and big lake/mountain views.

Click here for the full waterfront report with top sales for the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish. The data is interesting and insightful (but cannot replace an in-depth waterfront analysis with your trusted professional).

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Team RAREnorthwest and Baylee Reinert with Clarity NW Photography. Eastside cover photo courtesy of Donna Cowles and Kelly Morrissey with Clarity NW Photography. Mercer Island cover photo courtesy of the Oordt Ceteznik Realty Group and Clarity NW Photography. Condo cover photo courtesy of Fred Fox and Brandon Larson with Clarity NW Photography. Waterfront cover photo courtesy of Anni Zilz and Andrew Webb with Clarity NW Photography.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link